Cryptocurrency has taken the world by storm. It's been almost impossible to avoid over the last year. Especially with a lot of big-name institutional & financial companies like PayPal, Amazon, Tesla, Square, Mastercard, and Visa making huge investments in both the development and financial areas of “one of the biggest inventions on the internet since the internet itself”.

Although a lot of the attention has been about profits made by individuals and institutional investors in the market, the technology behind cryptocurrency and its different use cases seem to fly under the radar or are sometimes completely ignored.

Blockchain, the power behind cryptocurrency.

The idea of Blockchain technology— which has been around prior to the creation of digital currencies, is a structure that stores transactional records.

Typically, this storage is referred to as a digital ledger. Every transaction in this ledger is authorized by the digital signature of the owner, which authenticates the transaction and safeguards it from tampering. Hence, the information the digital ledger contains is highly secure.

In simpler words, the digital ledger is like a file shared among many computers (i.e. nodes) in a network. Within these nodes, transactional records are stored. These transactional records are based on actual purchases (authentication) and any changes made to this file are public to every node on the network. The fascinating part is that anybody can see the data which ensures transparency, but they can’t corrupt it.

Figure 1.00 A Blockchain network with its features enables the existence of cryptocurrency.

Smart contracts

A smart contract is a computer program or a transaction protocol that is intended to automatically execute, control, or document legally relevant events and actions according to the terms of a contract or an agreement. i.e. parties agree to certain conditions and a smart contract is written. If the conditions are met on the network, the smart contract can be partially or fully executed or enforced... without need for human interaction.

The objective of a smart contract is to reduce the need for trusted intermediates, arbitrations, enforcement costs, fraud losses, as well as the reduction of malicious and accidental exceptions.

This is implemented by cryptocurrency networks like Ethereum, Cardano, EOS.IO, Tezos, Solana, BNB Chain. These networks make it easier to write and deploy smart contracts on a blockchain by parties to settle transactions in various ways, among other use cases.

Financial services

Many financial institutions have expressed interest in implementing distributed ledgers for providing financial services and are cooperating with companies creating private blockchains, and according to an IBM study, this is occurring faster than expected.

Financial institutions are interested in this technology because it has the potential to speed up back-office settlement systems. With this implementation, many services can be automated which will save cost and time without compromising security and can also be trusted as all transactions are stored and visible on the network.

Cryptocurrency

The big one everyone seems to be interested in: Cryptocurrency is simply a digital asset designed to work as a medium of exchange. Using some principles as our traditional money, implementing some improvements with the understanding of economics (which explains the profits and losses from some cryptocurrencies) to create a medium of exchange that is faster, cheaper, more secure, and immutable.

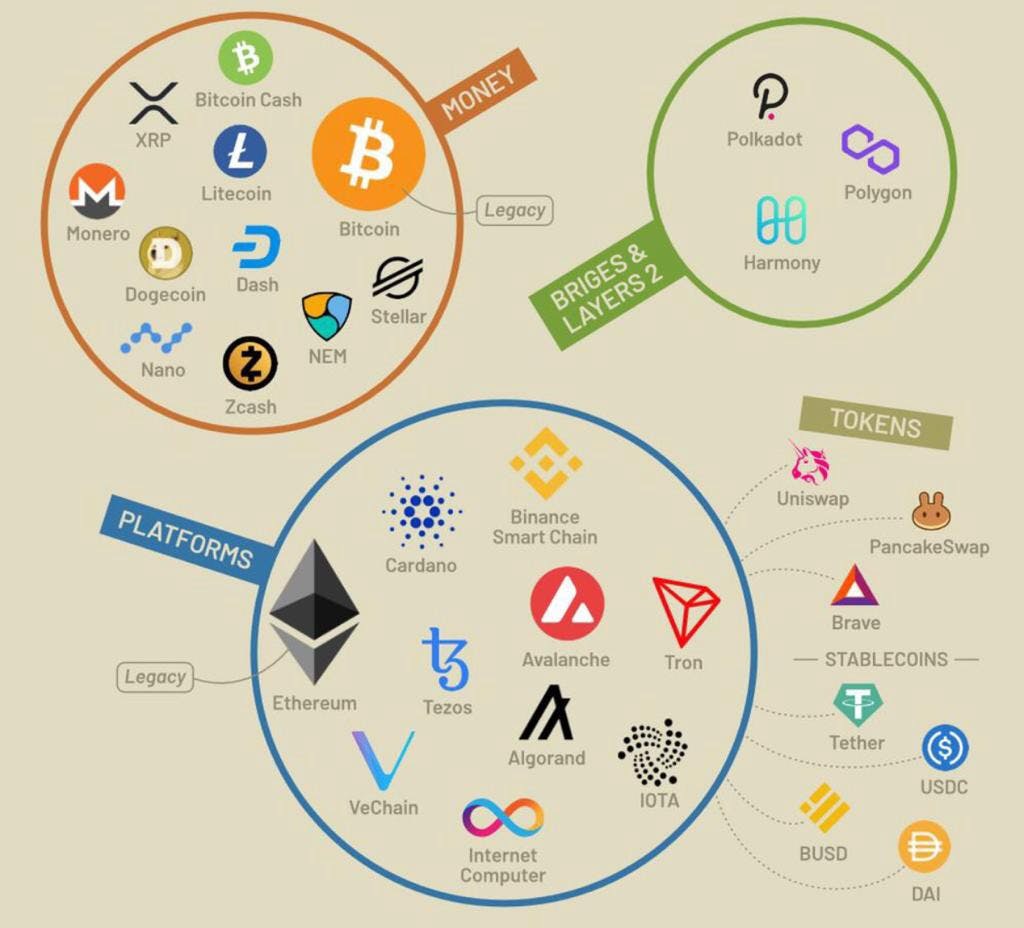

Some cryptocurrencies like Bitcoin, Dash, Nano were created primarily as a medium of exchange and a store of value whereas others like Ethereum, Polkadot, Theta (a favorite, the future of video streaming they say) serve as a medium of exchange and a network for other use cases.

Cryptocurrencies typically use decentralized control as opposed to centralized central banking systems. With the attention and development cryptocurrency has received, some central banks are considering rolling out their digital currency. Although, this would go against some principles of cryptocurrency, which aims to be a decentralized system, while some central banks are actually against it. We’ll have to watch and see how it goes.

Tokens

Another use case formed from implementing smart contracts (in most cases) is the creation of tokens used for NFTs, DeFi which have been another massive trend in the crypto space. These tokens represent tradable assets or utilities that reside on their own blockchains. They are usually created, distributed, sold, and circulated. They could represent items such as photos, videos, audio, and other types of digital files.

Keynotes:

Blockchain is a specific type of database and this enables many platforms, not just cryptocurrencies.

Crypto tokens are a type of cryptocurrency that represents an asset or specific use and resides on their blockchain.

Tokens can be used for investment, to store value, or to make purchases.

Cryptocurrencies are digital currencies used to facilitate transactions on the blockchain.

For example, you can have a crypto token that represents a certain number of customer loyalty points on a blockchain that is used to manage such details for a retail chain, there can be another crypto token that gives entitlement to the token holder to view 10 hours of streaming content on a video-sharing blockchain. Another crypto token may even represent other cryptocurrencies, such as a crypto token being equal to 15 Bitcoins on a particular blockchain. Such crypto tokens are tradable and transferrable among the various participants of the blockchain.

They are tons of crypto tokens with various use cases like Tether, Uniswap, Pancakeswap, Polygon, Brave, and literarily over 10,000 more tokens out there.

Tokenization of stocks is also occurring and some cryptocurrency exchanges are already offering so-called “stock tokens” like Binance offering Tesla, Apple, and Coinbase stocks(still watching to see how this one plays out).

Cryptocurrency Classification Other implementations of cryptocurrencies, smart contracts, and tokens on the blockchain are in:

- The video games industry

- Energy trading (used in peer-to-peer energy trading)

- Healthcare (to keep track of patient information and equipment)

- Anti-counterfeiting (used in detecting counterfeits by associating unique identifiers to products, documents, and shipments, and storing records associated to transactions that cannot be forged or altered.)

- Voting systems (which would improve the transparency from most electoral bodies) Supply chain(which would make a great impact as to improving the processes of managing supply chains in many industries with companies like Walmart and Amazon already implementing systems to ease its processes.)

Detour: Amazon has a Blockchain system “Amazon Managed Blockchain” which is a fully managed service that allows you to join public blockchain networks or set up and manage scalable private blockchain networks with just a few clicks and Oracle also offers an on-premise SaaS application blockchain network for businesses. Also, partnerships between Cardano and the Ethiopian Government to create a blockchain-based national student and teacher identification system. And subsidiary of supermarket giants like Walmart and Amazon partnering with Vechain blockchain (a cryptocurrency supply chain platform) to track consumer products. These are just some of the few of implementation of blockchain and cryptocurrency technology in the real world besides being used as a medium of exchange or store of value.

The adaptation of Blockchain technology since its advent has seen widespread acceptance into various industries and cryptocurrency has also seen a great number of public users using it as an exchange, store of value, and payments for goods & services, it still has some ways to go with some government regulations.

Although, many still believe that blockchain and cryptocurrency is an “overhyped technology” that has had many “proofs of concept” as many platforms are yet to fulfill their promises of what they offer and still have major challenges, and very few success stories. Overcoming these challenges would definitely not be easy as a lot of factors come into play for implementation and practical use to take place. Still, the possibilities of this space (blockchain and cryptocurrency) are almost limitless.