Whether you're new to the crypto industry or you've kept your eye on it for a while, you've probably heard about Bitcoin and would love to invest in it.

However, you find out that there are more than 1500 different cryptocurrencies and you don't know which to invest in, whether to just invest in Bitcoin and rest or invest in others as well. Although the crypto market is a very speculative one, there are a few conditions that could help you make the best investment choices.

Before we get started, please note that this article is not written as financial advice. Please do your due diligence to research and seek professional financial advice should you wish to invest.

A few questions to ask before investing in any project include:

How do I know a project will do well?

How is this project better than other projects?

Consider factors like; reasons behind the project, the solution it offers, the amount of capital, the location of the business, inflation rate, exchange rate, etc.

Digital assets like cryptocurrencies are not an exception to these factors. Hence the need for a proper fundamental and technical research before investing in any digital asset. Click here to learn more about how to make a proper Fundamental analysis (FA).

Among the many factors that can determine the efficacy of a project lies in its tokenomics, which can serve as an effective tool for making wise digital investments. Hence, what is tokenomics?

WHAT IS TOKENOMICS?

Tokenomics was coined from the term “token” and “economics”, and it comprises all the elements that give a token its value.

Note: A token is different from a coin however, for this article, we shall be generalizing them both as tokens. A few factors that may affect a project tokenomics include:

Token Supply

Token Demand

Token Usability

Token Distribution and Allocation

And we'll be going in-depth about what they mean and how they affect a project's value.

1. Token Supply

The supply of a token is an essential element to be considered in tokenomics. In simple terms, supply means the availability of a token.

In cryptocurrency, there are three (3) different types of token supply:

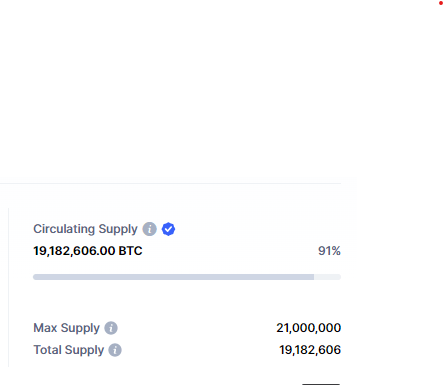

Maximum Supply

Total Supply

Circulating Supply

Maximum supply: This is one of the very first things to consider before investing in a crypto token. In simple terms, maximum supply is the maximum number of tokens a project may ever have throughout its lifetime. And for this cause, we shall consider the different types of tokens. There are two different types of tokens—deflationary and inflationary tokens.

Deflationary tokens are those types of tokens that have a specific number of tokens supplied throughout their lifetime. This simply means that more tokens cannot be mined nor printed once it has attained the maximum number of supply aforementioned. A very good example of this kind of supply is BTC, which has a maximum supply of 21 million BTC. A few others are BCH, Cardano, BNB, etc.

Inflationary tokens, on the other hand, have no specific number of supply throughout their lifetime and so, there is a massive flow of such tokens in existence so long as people make use of it. They are unlimited. A practical example of this supply is ETH, fiat currency, etc.

Total supply: Unlike maximum supply which is the number of tokens that will ever exist, total supply is the number of tokens that have been mined or printed so far. That is to say including the locked tokens, the burned tokens, etc.

Circulating Supply: This simply means the number of tokens currently in circulation. An increase in the circulating supply is a good indication that the token is doing well.

Note: Having too many supplies in circulation at a given time could be detrimental to the economy of a token.

Normally, when there is a high demand for a particular token, the price of that token could surge, thereby causing everyone to be in profit.

2. Token Demand

Demand goes hand in hand with supply. Ever wonder what gives a token its value? That is the law of demand and supply. When a token is in high demand, and the supply is limited, the value of that token usually skyrockets. However, when there is an unlimited supply of that token, with little demand, the price of that same token will fall. Hence the need to identify factors that could increase the demand for a token, like— utility, governance, security, use cases, news, rumor from influencers (which can be misleading as they can be used for pump and dump), an announcement from the team, etc.

3. Token Usability

It is imminent to understand the usability and do-ability of a token. This can be achieved by first identifying the type of token and its use cases. There are different types of tokens like utility tokens, security tokens, etc.

Utility tokens, for instance, serve as a liquid medium of exchange that gives one access to a value created by a blockchain network, while security tokens, on the other hand, are digital assets that represent a right to ownership or transfer of value on the blockchain. Read more

In addition, Identifying the use case of a token goes a long way to clarify the problem that the token solves, how it can solve it and who can use the tokens. Polygon, for instance, can serve a wide range of use cases, from becoming a better scalability solution to minting non-fungible tokens (NFTs), deployment of Ethereum-supported blockchain network and more. This simply proves that the project token (MATIC) is functional and usable.

4. Token Distribution and Allocation

This simply means how the tokens are brought into existence and how it is apportioned to everyone. We shall consider the 2 means of token distribution i.e., Pre-mined and fair launch.

Pre-mined token distribution: This means that some of the cryptos have been previously mined by some individuals or groups before the token is generally launched for others to partake in. Ether is a very good example of a pre-mined token distribution.

Fair launch: This type of token launch simply means that no one is given prior access to any part of the token until it is launched, thereby giving the general public access all at once. A very good example of a fairly launched token is BTC.

Having described these two types of token distribution, here are a few more things to consider:

Percentage of allocated tokens: For a pre-mined token, it is worth identifying the number of tokens allocated to these specific sets of people. The reason is, when a particular set of people has a large amount of a token, there is every tendency of a pump and dump. This is why you need to identify the amount allocated to them so that even though they decide to sell off their portion of the allocated tokens, it will have little or no effect on the entire project thereby minimizing the risk of the token being extinct.

Token release: This is another important metric to consider. Having identified the total supply of the token, it is also important to identify how these tokens will be released. For instance, if the whole token will be available all at once or if there is a scheduled release of tokens. This can be yearly, or after 3-4 years, etc. How long it takes to release a token helps to prolong the lifespan of that token as well as its value.

Token Incentive Mechanism: This is simply a way by which the token can yield more interest for its users, also known as Return on Investment (ROI). There is a need to identify the use cases and benefits of a token even before investing in it. A few incentive mechanisms to consider are lockups, staking pools, yield farms, lending and borrowing, etc. So, instead of allowing your tokens to just be in your wallet, you can utilize its incentive mechanism to your advantage.

Locked tokens simply mean the number of tokens that have been locked for a period of time, whereby the owners of the tokens may or may not have access to their tokens till the period has elapsed.

It is also an anti-pump and dump mechanism used to reduce the pump-and-dump scenario where early investors may want to sell off their tokens at public launch when the price of that token must have surged. Hence it is imminent to consider if there is a lockup period for a token before making any investment.

- Token Burn: Burned tokens are tokens that are intentionally destroyed to reduce the existence of that particular token in circulation, hence a reduction in supply. To burn a token, a stipulated amount of such tokens would be sent to a burned address (unknown address), without any private keys so that no one would be able to access it.

According to the laws of demand and supply, the scarcer a token, the higher the demand, which would increase the price of that particular token. And this is one of the many reasons why a few projects burn their tokens. A project like Ethereum has officially burned over 2million ETH tokens via the burning mechanism. Read more

Note: For any investment, ensure that at least 50-75% of the tokens is allocated to the community. This will mean that the project is a community governed project and the community has a say towards the growth and sustainability of the project, hence a signal for a long term project.

Conclusion

Tokenomics is a necessary tool to understand the key concepts for proper investment in cryptocurrency.

It is a part of fundamental analysis that can be used to determine the future of a token's value and what it might take to sustain that token hence, tokenomics is paramount to a token success story.